The creators of the app also created WeChat Pay for tourists and Chinese citizens alike. If a user wishes to make a payment through another app, they must give WeChat permission to carry out the transaction. In-app Payment – Smartphone users can integrate WeChat Pay into their other apps.

#Wechat payment fraud code#

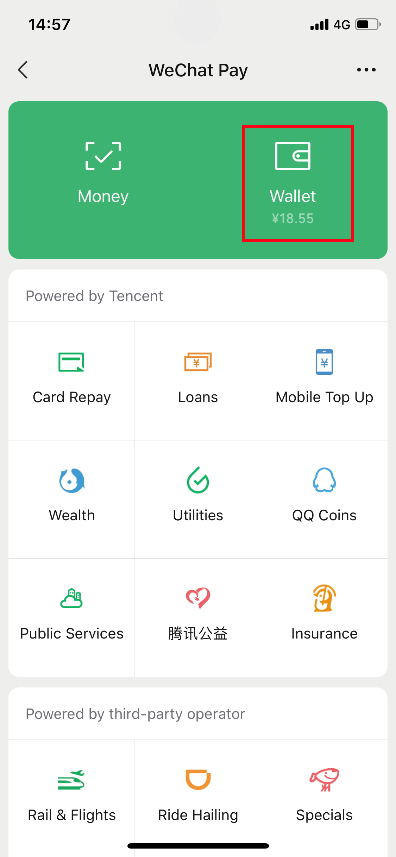

When a QR code is scanned, the user has the option to purchase the corresponding product via the app. QR Code Payment – Chinese vendors create different QR codes for different products.In-app Web Payments – Followers of retailers and other vendors can purchase products and services offered by online retailers.QR Code Scan (Quick Pay) – Allows the vendor to scan QR codes on customer phones.The following types of payments can be accepted through the app: WeChat Pay users have access to a wide variety of payment methods, and many Chinese citizens and businesses appreciate the app’s versatility. Vendors agree to accept these currencies, and if your country’s currency is not supported, transactions can be made in USD. WeChat Pay supports a large number of currencies, which include, but are not limited to USD, CAD, EUR, GBP, AUD, and NZD. Once the buyer confirms the deal in the app, the money will be deducted from your home account. If you choose to make a purchase in China, the app will automatically convert your currency into CNY (and vice-versa for tourists). A significant number of Chinese citizens use WeChat Pay instead of paper currency, and as a tourist, setting up a WeChat Pay account can make purchasing products, sending money, and paying bills considerably easier. What is WeChat Pay?Īs stated above, WeChat Pay allows individuals to make electronic payments using their smartphone.

Fortunately, WeChat pay for tourists, including study abroad students, can be used to purchase items in China. WeChat Pay, which is fully integrated into the WeChat app, is popular among Chinese companies, private citizens, and small businesses. Over time, the app has expanded to allow Chinese citizens and tourists to make electronic payments. With more than 650 million daily users, the app has become one of the most heavily used in existence. At the end of last year, WeChat announced that users now had the capability to share links from external sites, even Alibaba’s Taobao.WeChat, a Chinese social media platform, is one of the most popular chat apps in the world. Over the past decade, mobile payments became the primary payment method in mainland China, and WeChat Pay and Alipay became the most popular ways to buy goods and services. Read more: Tencent’s WeChat Pay Envisions Future Where Payment Options are the Norm The People’s Bank of China didn’t immediately respond to a request for comment and Tencent representatives declined, Bloomberg reported. WeChat also could be compelled to offer easy access to Alibaba’s Alipay.

There will likely be additional capital requirements and more oversight by regulators. The details of how WeChat Pay’s move would affect interoperability between different platforms is still being considered, the sources told Bloomberg.

Chinese regulators concluded this was inadequate to encompass the services included in WeChat Pay, the sources said.

#Wechat payment fraud license#

Tencent’s payments license is owned by TenPay division, which is the back-end provider of wallet services on WeChat and QQ. The app has over one billion users and is among China’s most valuable firms. Removing its payments services would reduce its super app capabilities and overall convenience. WeChat Pay handles billions of dollars every day but is a transactional platform only and doesn’t extend loans. See also: China's Regulator Orders Tech Companies to Open 'Walled Gardens' Similar to Ant Group, regulators could force Tencent to spin off its banking, securities, insurance, and credit-scoring services into its separate financial holding company and operate separately from the firm’s social media company, the sources said. The possible decision is part of China’s crackdown on tech companies last year, mandating that corporate divisions offering financial services had to be separated from the main business and regulated like a traditional bank. Regulators in China could force Tencent to spin WeChat Pay into its newly-created payments subsidiary, which could cause the need for the mobile payments service to obtain a new license, Bloomberg reported on Friday (March 18), citing sources with insider information.

0 kommentar(er)

0 kommentar(er)